Words: Joseph Bullmore

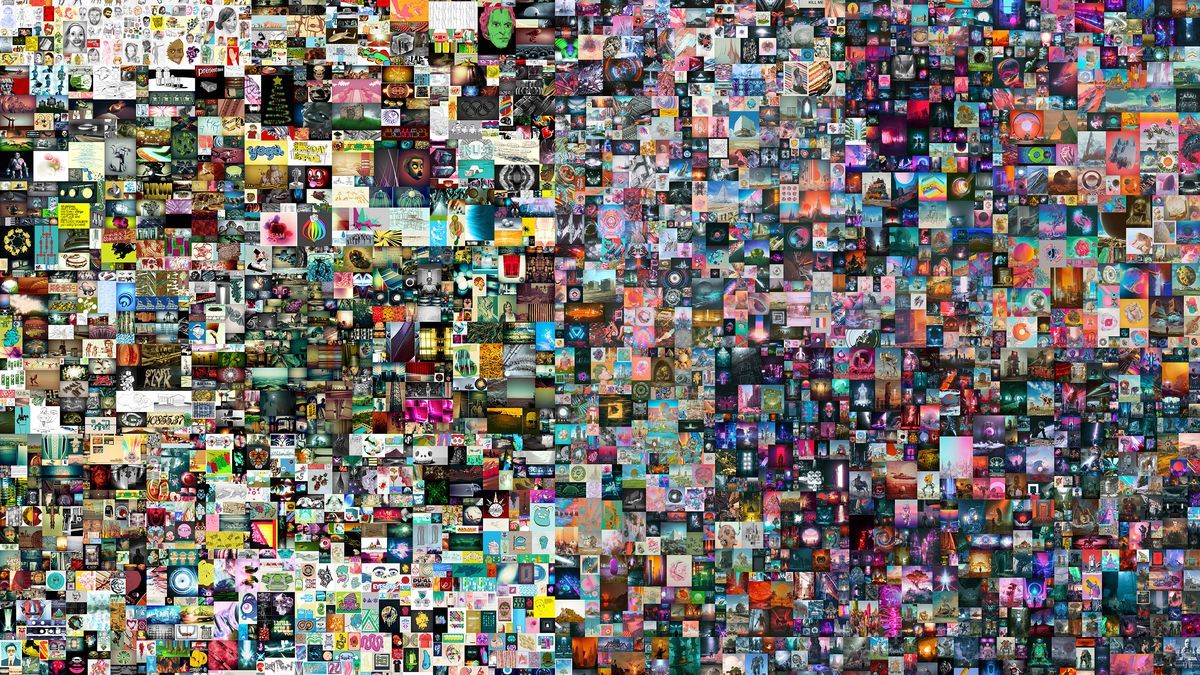

If the art market didn’t exist, you’d struggle to make it up. Too silly, your editor would say; people just don’t behave like that. Viewed from any sort of distance at all, the groaning, rickety artifice seems like one big, bizarre in-joke; a spaghetti junction of back-slapping contacts, racketeering gallerists and pretentious drop outs, post-rationalising meaning into an ironic photo collage where Linsday Lohan appears to be the Queen, only everyone is also a dog. It’s an avant garde theatre show, where lithe men in good suits at august establishments with expensive townhouses tell you that a really quite ugly and not very nice thing is actually really quite lovely and very brilliant indeed, and also $26.6 million. But thus far, at least, you could just about keep up. There was some logic to this dramatic universe, no matter how fantastical or twisted or self-reflexive. It was like Star Trek, or perhaps Game of Thrones. I get it, fine — you have fun. But I’ll leave you to it, if that’s okay. Too many dragons.