The GameStop coup explained: a case of delirious revenge

Degenerates, diamond hands and delicious downfalls: inside the world of Wall Street Bets

It was 2011, back in the fractious days of Occupy Wall Street, and thousands of protesters were roaring through Manhattan’s financial district to denounce the evils of the one percent. One September afternoon, they marched past Cipriani Club 55, which to the finance world is a swish joint that serves thirty-dollar salads and sautéed veal — but which to the demonstrators might as well have been the embassy for Hell. Right there, up on the restaurant balcony, a group of suited financiers clutched their flutes of Perrier-Jouët Belle Époque Blanc de Blancs, and started jeering at the crowd. You can imagine their jabs: Get a load of these losers! Get a job, ya lousy degenerates! They pointed, laughed and took pictures of the great unwashed — it is one of the enduring scenes of that era: the clueless rich versus the furious rabble. Those memories of elitist mockery have not been forgotten, and so the havoc that has been unleashed onto the financial world this month with the GameStop fiasco is nothing less than delicious revenge a decade in the making.

The balcony at Cipriani 55, where Wall Street grandees sipped champagne during the Occupy protests

We are now witnessing the second act of Occupy, according to some observers, with the question about who in America is allowed to make money back on the agenda. Is it the little guy, or is it just hedge fund goons with impressive degrees and the right tailor? Who deserves to win, in other words: David or Goliath?

The battleground this time around is a Reddit forum called Wall Street Bets, a raucous hub for casual traders to recommend deals and share memes. Their tagline is “like 4chan found a Bloomberg terminal”, referring to the terrifying anything-goes message board and the financial news service. WSB-heads started buying stock in GameStop, a beleaguered video game retailer whose stores have suffered from declining sales and unstable leadership. Hedge funds, on the other hand, had bet heavily on the stock going down in a process known as short selling. This is when hedgies borrow shares and sell them in the hope that the price will drop so they can buy those shares back at a lower price, return them to the person they borrowed them off, and keep the change.

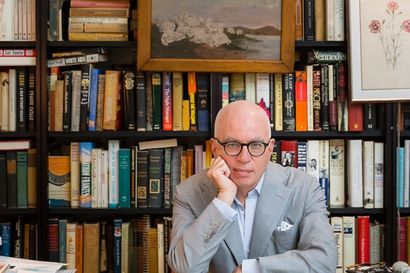

Gabriel Plotkin, the founder of hedge fund Melvin Capital, which lost $19 billion dollars in the stunt

What they hadn’t contended with was the horde of WSB recruits (seven million and counting) who were willing to invest in GameStop, causing the price to go up into space. It went so high that hedge funds started to lose serious money — they couldn’t hope to return the shares they sold at a way lower price for a profit. By some estimates they have lost around $19 billion. One firm, Melvin Capital, closed out its position in GameStop and was only kept afloat thanks to a $3 billion infusion from Citadel and Point72, two other funds.

GameStop, the floundering electronic store that has had its stock market fortunes dramatically revived

Spending time on the WSB board is like chugging a dozen espressos and going on a rollercoaster. There is a dizzying lingo, some of which reflects the forum’s behind-the-bike-sheds attitude. Users call themselves “degenerates” (in a nod to their perception by the Wall Street elite) but also “autists” and “retards” — not the sort of language you’d want to explain in court by any means, but it is spoken on WSB with the sort of affection that you might use to jokingly describe a friend with a certain four-letter Latin noun. “Diamond hands” belong to those who are ready to hold their shares through thick and thin while “toilet paper hands” are for wusses who sell too early. “Tendies”, which in internet speak means chicken tenders, are money, and if a stock is “going to the moon” or “mooning” it’s going up.

Traders rejoice when their earnings contain the digits 69 and 420, and there’s a running joke about “my wife’s boyfriend” (e.g. “Waiting for my wife’s boyfriend to give me my weekly allowance so I can buy more stock”). The devotion to these gags is intense: one man rented seven billboards along every major highway in Orlando “to show the world I love GME”, which is GameStop’s ticker symbol, and others have paid for painful tattoos of diamonds on the palms of their hands. On the weekend, a user hired a giant screen on Times Square in New York to praise GameStop.

Keith Gill, the unlikely messiah figure at the heart of Wall Street Bets

The big name on WSB is DeepFuckingValue, a figure with Jesus-tier importance. He is in fact a mild-mannered former marketing manager named Keith Gill. He began investing in 2019 when GameStop was around $5 a share, convinced that the company wasn’t going the way of Blockbuster, and put in more than $50,000 with the mantra of YOLO. It worked. Gill’s stock, at one point this month, was worth $50 million. In the last week, his successful trade has inspired legions of others to follow suit and the cost of a share rose to $469. “To Alpha Centauri with our king,” wrote one fan under his forum posts. “He is our god,” said another, “now and forever!” In real life, Gill is not quite the deity that his followers believe him to be. In a polite interview with the Wall Street Journal, he said he would like to use his new wealth to build an indoor running track in his hometown in suburban Massachusetts. How sweet.

Vladimir Tenev, the founder of trading app Robinhood, has become a target of the WSB revolution

Gill has inspired an army of recruits to wage a battle royale with Wall Street over GameStop. What the tendie-seekers hope for is a short squeeze – when hedge funds are forced to abandon their positions by purchasing their shares at a loss, ultimately sending the price up even higher. Hence the popular phrase asked of all WSB traders – “Hold the line!” – aimed at those wondering if they should now cash out or wait for the mythical short squeeze. These three words have found their way into countless viral clips as traders reimagine themselves as characters from Braveheart and Lord of the Rings heading into battle.

Their main enemies now are the talking heads going on business news shows to denounce WSB as an unwashed mob sabotaging America’s financial institutions. One such hate figure is Leon Cooperman, known as “the crying billionaire” for tearing up in a TV interview a while back over the “vilification of billionaires” and the quite outrageous suggestion that they should pay their fair share of tax. Cooperman made an ill-advised return to the airwaves last week to denounce amateur traders for “attacking wealthy people”. “I think it’s inappropriate,” he said. He has become another object of WSB’s anti-boomer derision.

A plane flies a 'Suck My Nuts' banner over Robinhood HQ in California

But the big baddie is Robinhood, the trading app that most of WSB used to buy their stocks on, which last week halted sales of GME to small-time buyers. Vlad Tenev, Robinhood’s CEO, dismissed claims that this was a shady deal agreed at the behest of hedge funds, insisting it was down to “market dynamics and clearinghouse deposit requirements”. Try telling that to WSB, one of whose followers paid for a plane to fly over Robinhood’s California HQ with a banner that read “suck my nuts”.

"Hold the line!": the Reddit forum is now squaring up for a battle royale with Wall Street

This hooha over the trading halt, along with an SEC warning that stock price volatility could “undermining market confidence”, has prompted the most unlikely alliance. There is now a Molotov-Ribbentrop pact uniting the likes of Elon Musk and Ja Rule, both fans of WSB, as well as oleaginous free market ghouls like Ted Cruz and bank-busting lefties like Alexandria Ocasio-Cortez. All of them see Robinhood, hedge funds and the SEC as getting in the way of that great American tradition: getting very rich. Musk even interrogated Tenev on a Clubhouse stream and asked if something “shady” happened with Robinhood’s handling of GameStop.

So what happens next? It depends who you ask. Some market watchers say Wall Street will weather the storm and the amateurs will lose all their money. But to listen to the traders on WSB, it feels like blueprints are being finalised for a nifty little gadget called the guillotine. First stop: Cipriani Club 55.

Read next: the rise of the ‘Mobfluencer’

Become a Gentleman’s Journal Member?

Like the Gentleman’s Journal? Why not join the Clubhouse, a special kind of private club where members receive offers and experiences from hand-picked, premium brands. You will also receive invites to exclusive events, the quarterly print magazine delivered directly to your door and your own membership card.