The nature of exclusivity is a tricky thing. Especially so when it comes to businesses looking to expand grow while retaining a sheen of discernibility. Case in point: Soho House, which just announced its IPO.

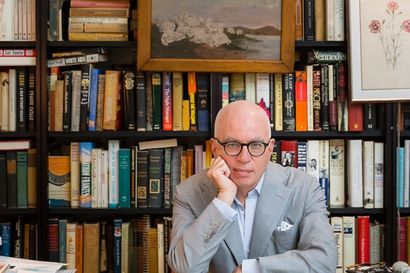

“As Soho House heads toward an IPO, the members’ club for the creative set may see any remaining air of exclusivity go up in flames,” argues Nimrod Kamer in an in-depth piece on the bohemian brand soon to turn public entity in Airmail News.

Kamer has a point. What began as a humble, underground workspace for creatives has become perhaps the most ubiquitous – not to mention most Instagrammed – chain of members clubs in the world. With over 27 locations in 10 countries (plus new openings in Tel Aviv, Austin, Rome, Paris, and Brighton, UK) detractors argue that the chain lost any claims to exclusivity and choosiness years ago.

Become a Gentleman’s Journal Member?

Like the Gentleman’s Journal? Why not join the Clubhouse, a special kind of private club where members receive offers and experiences from hand-picked, premium brands. You will also receive invites to exclusive events, the quarterly print magazine delivered directly to your door and your own membership card.