Should you still be investing in wine?

‘The first thing to say is that if you’re dreaming of uncovering a previously unknown cuvée that quadruples in price overnight, forget it’

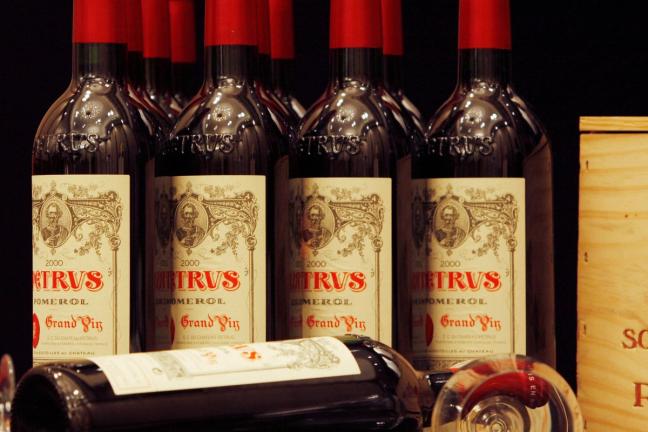

For the last 20 years, fine wine has represented arguably the most reliable commodity in terms of financial investment, often delivering double-digit annual returns and providing more reward than stocks, shares and even gold. The last 12 months, however, have seen a dip in this area, with many portfolios ending the year in negative territory compared to when they started it. If not quite a bubble bursting, the slide certainly suggests a ‘correction’, as analysts call it. So, is investing in wine still a good bet?

The first thing to say is that if you’re dreaming of uncovering a previously unknown cuvée that suddenly becomes hugely desirable and quadruples in price overnight, forget it. The closest we came to that was in the 1990s, when the so-called Napa ‘cults’ of Screaming Eagle, Harlan Estate and the like raced to prominence via the enthusiastic scores of uber-critic Robert Parker, and demand for their scarce output spiralled as a result.

Today, there are few – if any – such unknown start-ups that are likely to make the same impact; Parker has retired; and no critic wields his sort of influence on the market. Instead, the wines most likely to accumulate value tend to be the familiar, bluechip names that already have a fairly sizeable price tag on release. As a result, would-be investors looking to kickstart a portfolio will need a fairly generous budget to begin with.

Burgundy has been the source of the most spectacular gains over the last few years, partly on account of the fashion for lighter, less full-bodied wines; partly due to Bordeaux fatigue; and partly because the production of such wines is relatively small, leading to more immediate supply-and-demand-driven price escalation. And, though this means that the occasional producer can increase in profile (and price) relatively quickly (Burgundy’s wines, being graded by vineyard rather than producer, are not as hierarchical as Bordeaux's, where the 1855 classification sees a château’s ranking set in stone), any investment-worthy Burgundy is going to be pretty pricey to start with (not to mention hard to get hold of, and likely available on allocation to regular customers only).

And, it was Burgundy that, after some bewildering price increases over the last couple of years, bore the brunt of the price drops in 2023. According to Liv-ex, a global database and marketplace for fine wines, Burgundy’s share of the market dropped from 31 per cent to 24 per cent last year, with more cautious buyers wary of paying sky-high prices, particularly for less well-established brands.

Liv-ex points out that all of its major indices of fine wines were down by double digits in 2023, a year it describes as “challenging”. Worse still, it adds, the market is facing up to a bleak 2024, with no indication, yet, that prices have bottomed out, with buyers increasingly focusing on safe bets such as mature Bordeaux, which Liv-ex describes as “the safest, best-known market that many collectors default to in [times] of turmoil”.

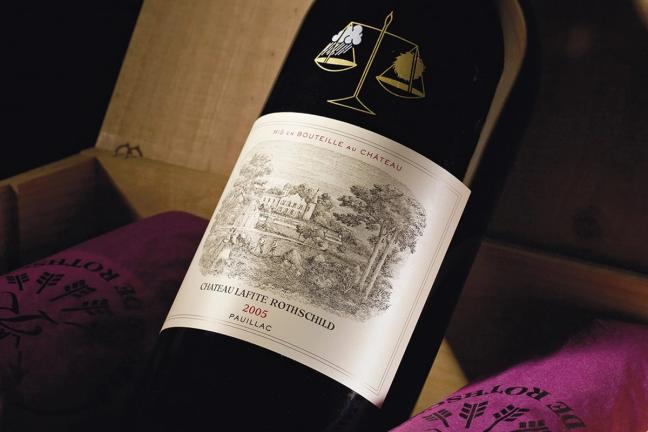

And, that’s the thing – ultimately, the most surefire winners in wine investment terms are the predictable names: Lafite, Latour, et al. “Collectors are narrowing their focus to the most established brands in the market, the ones most likely to hold their value,” Liv-ex’s annual report says. It's a view shared by Matthew O’Connell, head of investment at fine-wine trader Bordeaux Index, who says that younger wines, often released at what now seem inflated prices, are unlikely to reap reward. “This dynamic can be seen from the substantial underperformance of younger vintages in Bordeaux (especially 2018, 2019 and 2020).” He adds, though, that there are still “clear opportunities” in “older wines [that] have also drifted and are simply too cheap, especially given the relative lack of supply some now exhibit.”

All in all, though, says O’Connell, “The market has seen particularly depleted activity in 2023, with this stagnation increasing as the year has progressed. After such a strong run [especially for Champagne (+69%) and Burgundy (+58%) across 2021–2022], a settling of activity and prices was to be expected. However, the year saw a decline far beyond our initial expectations and this meaningfully impacted prices, especially in the second half.” The market, as a whole, was down 12 per cent across 2023, he says, with Champagne, young Bordeaux and certain Burgundy pockets most affected.

So, what should would-be investors be looking at in 2024 – if at all? “We’ve said it before and must say it again,” says O’Connell. “We are very wary of most producers below the top 25 bluechip names, for whom pricing is artificially inflated by allocation-tying and demand in the marketplace is very low.” As a result, though there has been some increased trading in other regions – notably Italy (more Piedmont than Tuscany), Champagne and California – such gains tend to be more modest and transitory than the longer-term performance of the classics.

“Other regions [US, Rhône, Italy (Piedmont)], for the most part, continue to struggle for focus in the core fine-wine market,” says O’Connell. “This should not be confused with a lack of broader relevance, however – there is much to like for fine-wine collectors in these regions, but that is simply a separate point to market-trading relevance.” In other words, the likes of Barolo and Côte Rotie now offer good value for collectors looking to buy fine wine to keep in the cellar and eventually drink. Just don’t expect to make any money on them.

Where there might be an opportunity is in a slightly removed category: whisky. Countless records have been set and broken in recent years, mostly by one-off releases from casks that have been hiding away in distillery cellars for decades. Bordeaux Index has seen rare whisky continue its upwards trajectory of recent times, with prices, on average, growing by 13 per cent in 2023, according to O’Connell. “The rare-whisky market is ultimately in much better shape than the fine-wine market,” he says.

With Japanese whisky having apparently topped out, it is Scotch that is behind most of this growth, with brands such as Springbank, Balvenie and Dalmore doing particularly well, and “Macallan performing better in cask than in the top bottlings,” says O’Connell.

As more and more distilleries release special-edition lots, casks and bottlings, it could be that whisky, rather than wine, is where the opportunities lie.

Want more drinks content? From the Gymkhana team comes 42, an all-senses-required take on a cocktail bar…

Become a Gentleman’s Journal Member?

Like the Gentleman’s Journal? Why not join the Clubhouse, a special kind of private club where members receive offers and experiences from hand-picked, premium brands. You will also receive invites to exclusive events, the quarterly print magazine delivered directly to your door and your own membership card.

Further reading

Restaurant review: with ABC Kitchens, Jean-Georges Vongerichten produces yet another multi-layered venture

Defined by power and body, this is why the Penfolds Bin 707 is analogous to a jumbo jet