Five most infamous hostile takeovers of all time

You’d be forgiven for thinking hostile takeovers were out of fashion, but Pfizer’s attempts to absorb AstraZeneca earlier in the year showed us that it’s still very much an option for large firms. You almost might think they’re very exciting. You’d be right.

1. AOL and TimeWarner

When AOL took over TimeWarner, a much larger firm, it was hailed the ‘deal of the millennium’ at the time. Oh how wrong they were. The newly crowned largest media company in the world saw its value destroyed when the dotcom bubble burst, and they subsequently split later on, with the new company losing over $200 billion within two years, more than the $164 billion value of the initial deal. At the moment, needless to say, AOL look a little worse for wear.

2. Sanofi-Aventis and Genzyme Corp

Pharmaceutical giants, Sanofi-Aventis, endured a tough time when attempting take over biotechnology company, Genzyme, in 2010; they were forced offer significantly more than their valuation of Genzyme’s shares in order to assume control of the company, after Genzyme’s board of directors had issued a unanimous ‘no’ verdict.

3. RBS and ABN AMRO

In what was the world’s biggest banking transaction of its time, things got hostile when ABN AMRO’s board did not recommend either the RBS Consortium’s offer, nor did it offer support for the rival offer from Barclays. The deal was contingent on ABN AMRO’s sale of its banking arm to the Bank of America, which eventually facilitated a €70 billion purchase on behalf on RBS. With the credit crunch just the following year in 2008 however, this may not have been the wisest move. Hindsight is a lovely thing.

4. Icahn Enterprises and Clorox

A dramatic turn of events coming from the very top of the buying party started with Clorox rejecting Icahn’s opening bid of $10 billion. The buyers’ CEO, Carl Icahn, then went on to send an email, in full capital letters, to the Clorox board, arguing that the shareholders should decide on the takeover. His capitalised rant wasn’t heeded though, as Icahn were eventually forced to withdraw their bid, despite the bid eventually reaching $11.7 billion.

5. Vodafone AirTouch and Mannesmann AG

In the largest hostile takeover in history, Vodafone acquired German firm, Mannesmann AG, for $202.8 billion in 1999. This was before Vodafone reverted to its original name, ‘Vodafone Group,’ in 2001, and the agreement finally came after Mannesmann’s largest investor pleaded with the board to accept Vodafone’s offer. It eventually concluded amicably, with, controversially, millions going to members of the Mannesmann board in the form of bonuses. Needless to say, there were legal issues in the aftermath.

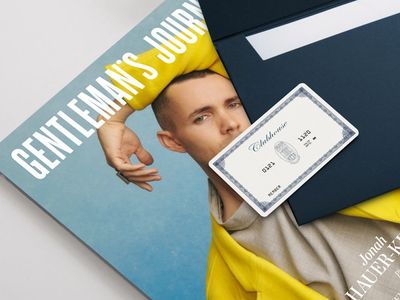

Become a Gentleman’s Journal Member?

Like the Gentleman’s Journal? Why not join the Clubhouse, a special kind of private club where members receive offers and experiences from hand-picked, premium brands. You will also receive invites to exclusive events, the quarterly print magazine delivered directly to your door and your own membership card.